Top 10 Tax Havens in USD

-

Sep, Thu, 2024

Top 10 Tax Havens in USD

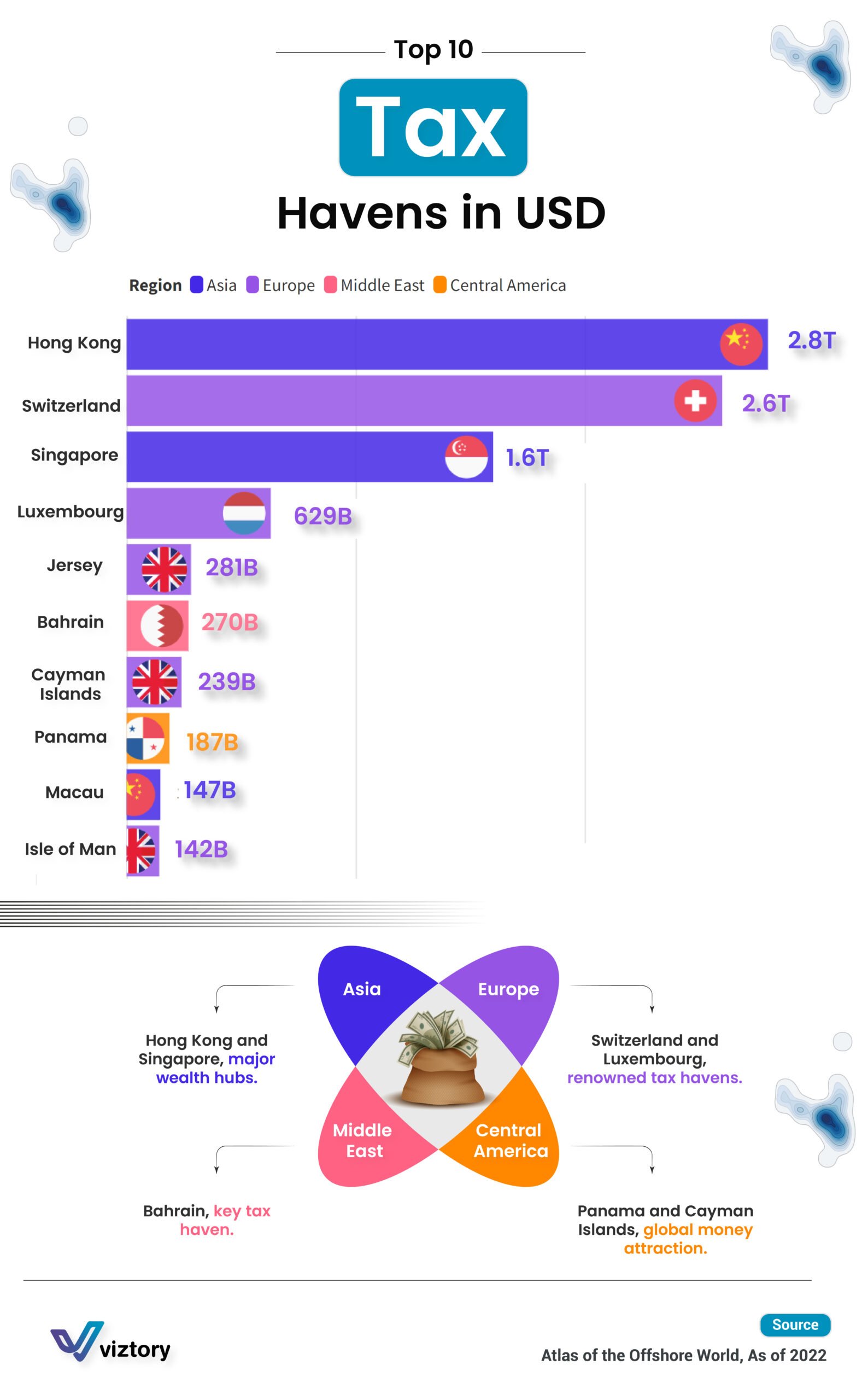

The image highlights the top 10 tax havens across the world, showcasing how trillions of dollars are stored in these jurisdictions to take advantage of favorable tax policies and low transparency. These tax havens represent critical nodes in the global financial system, playing a significant role in the movement and protection of wealth, particularly for high-net-worth individuals and corporations seeking to minimize their tax liabilities.

Tax Havens and the Global Flow of Money

Tax havens are often associated with the avoidance of taxes and regulatory scrutiny. These jurisdictions provide legal environments where individuals and businesses can park their wealth with minimal tax obligations. This practice affects global economies by redistributing wealth in ways that reduce tax revenues in higher-tax countries while attracting global money flows into these regions.

Top Players in the Tax Haven Ecosystem

The chart reveals that Hong Kong leads the pack with 2.8 trillion USD, followed closely by Switzerland with 2.6 trillion USD. Both of these countries are well-known financial hubs, offering strong banking secrecy and sophisticated financial services.

Singapore follows with 1.6 trillion USD, benefiting from its role as a major financial center in Asia, particularly for wealth coming from China and Southeast Asia.

Luxembourg, known for its favorable corporate tax structures, has 629 billion USD in holdings, positioning itself as a major player in Europe’s tax haven network.

Smaller yet significant players like Jersey, Bahrain, Cayman Islands, Panama, Macau, and the Isle of Man round out the top 10, each with hundreds of billions of dollars in wealth. These jurisdictions are highly favored for their minimal corporate taxes and regulatory oversight.

Regional Dynamics

The image divides these tax havens by region, illustrating the global distribution of wealth management hubs:

Asia: Hong Kong and Singapore are highlighted as major wealth hubs, attracting large sums of capital from the region.

Europe: Switzerland and Luxembourg are renowned for their banking secrecy and tax advantages, making them key destinations for European wealth.

Middle East: Bahrain is one of the few Middle Eastern tax havens, known for its minimal taxation on foreign capital.

Central America: The Cayman Islands and Panama are global magnets for offshore money, with attractive tax policies for corporations and the wealthy alike.

Money and Tax Havens

The existence of tax havens has created significant discourse in the financial world, particularly around the ethics of wealth redistribution and tax avoidance. For high-net-worth individuals and multinational corporations, storing money in these regions means safeguarding wealth from higher taxes, which affects global financial equity. At the same time, tax havens have become integral parts of the global financial system, where trillions of dollars move freely, often without the scrutiny of tax authorities.

Conclusion

Tax havens, as illustrated by the chart, represent a crucial yet controversial element of the global money flow. These financial safe zones allow for the accumulation and protection of wealth, offering favorable tax conditions and legal protections that attract trillions of dollars from around the world. The chart sheds light on the immense scale of money flowing through these havens, emphasizing the complex interplay between global finance, tax policies, and wealth management.