Major Countries’ Estimated Annual Real GDP Growth Over 10 Years

-

Oct, Fri, 2024

Major Countries’ Estimated Annual Real GDP Growth Over 10 Years: Financial Implications and Investment Insights

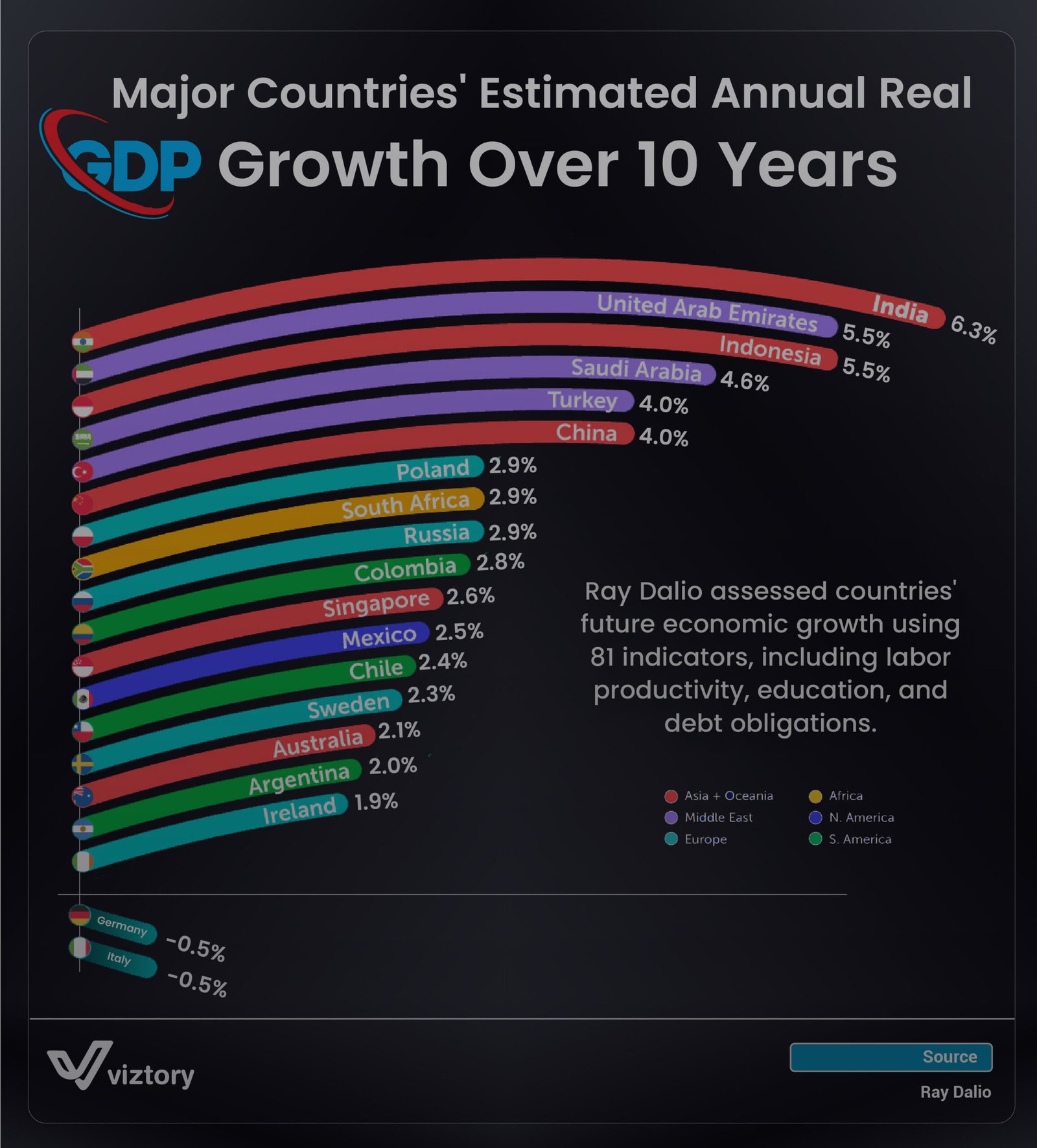

The visualization illustrates the projected real GDP growth rates of major countries over the next decade, with India leading at an estimated 6.3%, followed by the UAE and Indonesia at 5.5%. In contrast, countries like Germany and Italy are projected to experience a slight decline at -0.5%. These GDP projections provide a glimpse into the future economic landscape and have significant financial implications for investors, businesses, and policymakers as they navigate global markets.

High-Growth Markets and Investment Opportunities

Countries with high projected GDP growth, such as India, UAE, and Indonesia, represent attractive opportunities for investors. These economies are likely to see increased consumer spending, infrastructure development, and a growing middle class, which can drive demand across various sectors. Investors may find opportunities in emerging markets, particularly in industries like technology, real estate, and manufacturing. For instance, India’s rapidly growing economy makes it a prime destination for investments in tech startups and infrastructure projects.

Financial Challenges for Low-Growth Economies

On the other end of the spectrum, economies like Germany and Italy face growth challenges that may impact their financial stability. Negative growth rates can lead to reduced investor confidence, affecting currency values and limiting capital inflows. These countries may experience tighter fiscal policies, reduced public spending, and increased borrowing costs as they work to stimulate growth. For businesses operating in these markets, understanding these economic conditions is crucial for managing risks and making informed financial decisions.

Emerging Markets and Economic Diversification

Many of the countries with strong GDP growth projections, such as Saudi Arabia (4.6%) and Turkey (4.0%), are focusing on economic diversification to reduce dependence on traditional sectors like oil and tourism. By investing in new industries, these countries aim to create more resilient economies that can withstand global market fluctuations. For investors, this shift presents opportunities to tap into new sectors and support innovation in regions that are actively pursuing economic transformation.

Impact on Global Trade and Capital Flows

The varied growth rates among major economies will likely influence global trade patterns and capital flows. For instance, countries with higher growth rates may increase their imports of goods and services, benefiting trading partners. Conversely, lower-growth countries may focus on boosting exports to compensate for domestic economic challenges. Investors should consider these dynamics when developing global investment strategies, as countries like China (4.0%) and South Africa (2.9%) continue to play significant roles in international trade networks.

Conclusion

Projected GDP growth rates offer valuable insights into the financial prospects and economic health of major countries. High-growth markets present lucrative investment opportunities, while low-growth economies may face financial challenges that require strategic adaptation. By understanding these growth trends, investors, businesses, and policymakers can make informed decisions that align with their financial goals, allowing them to capitalize on emerging opportunities and navigate potential risks in the evolving global economy.