AI Hyperscaler Spending Surge

-

Mar, Tue, 2025

Introduction

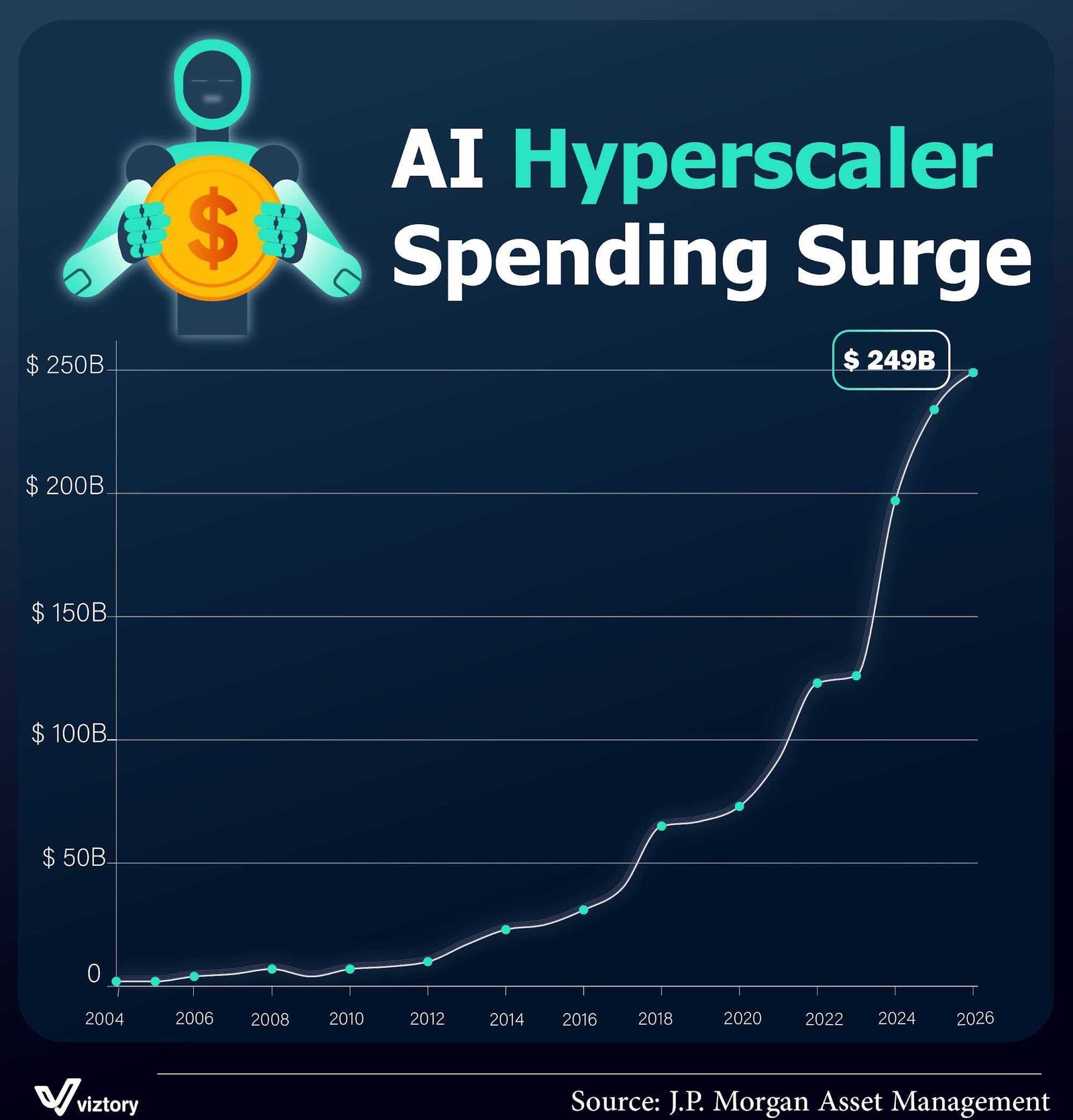

Over the past two decades, artificial intelligence has shifted from a research-focused niche to a mainstream technological revolution. A key driver behind this transformation has been the unprecedented surge in investment from hyperscalers — massive tech firms with global-scale infrastructure such as Amazon, Microsoft, Google, and Meta. The infographic above, based on data from J.P. Morgan Asset Management, illustrates the meteoric rise in AI-related spending, reaching $249 billion by 2025.

From Experimentation to Full-Scale Investment

In the early 2000s, AI spending was minimal and experimental. It wasn’t until around 2015 that spending began to rise significantly, as breakthroughs in deep learning, cloud computing, and data availability began to show real-world commercial promise.

The graph shows a steady incline from 2010 to 2018, but a dramatic spike starts after 2020 — coinciding with the pandemic-era digital acceleration and the AI boom that followed innovations in large language models (LLMs) like GPT.

Tech Meets Finance: The Business Behind the Billions

Spending nearly $250 billion on AI is not just about technology—it’s a financial strategy. Hyperscalers are betting big on AI’s ability to:

- Optimize supply chains

- Enhance customer experience through personalization

- Automate operations at scale

- Open new revenue streams in sectors like healthcare, finance, and media

Investors are watching closely. AI isn’t just a technological play; it’s now a major financial asset class, driving up valuations, stock prices, and capital flow into the tech sector.

Investment Drivers

🔹 Cloud Infrastructure Expansion

To train massive AI models, hyperscalers need vast amounts of compute power and storage, fueling huge investments in data centers and GPU clusters.

🔹 AI-as-a-Service (AIaaS)

Companies are commercializing their AI capabilities, offering APIs and platforms that other businesses can plug into — turning AI into a profitable service.

🔹 Talent and Acquisitions

A large portion of this spending goes toward acquiring startups, hiring top researchers, and securing partnerships in AI innovation.

Economic Implications

This surge in AI spending will likely impact:

- Employment landscapes, with increased demand for AI specialists but potential job displacement in routine roles.

- National economies, as governments and regions with tech leadership gain geopolitical leverage.

- Market competition, where companies unable to keep up with AI integration may fall behind rapidly.

Analysis

The chart is a visual testimony to how AI has become the centerpiece of digital transformation. What was once a slow and linear evolution has turned exponential. The curve’s steepness post-2020 reflects a paradigm shift — not only in the technology’s maturity but in the financial trust placed in it.

It’s no longer about “if” AI will reshape industries — it’s about “how fast” and “how deep” the transformation will be. The $249B projection shows that hyperscalers are positioning themselves not just as adopters, but as architects of the AI economy.

Conclusion

The AI Hyperscaler Spending Surge represents a bold investment in the future of technology and the global economy. As spending accelerates, the ripple effects will be felt across industries, societies, and markets. Those who understand and adapt to this transformation — whether companies, investors, or policymakers — will be best positioned to thrive in the AI-driven world ahead.