The GDP Impact of Trump’s 10% Tariffs on China

Introduction

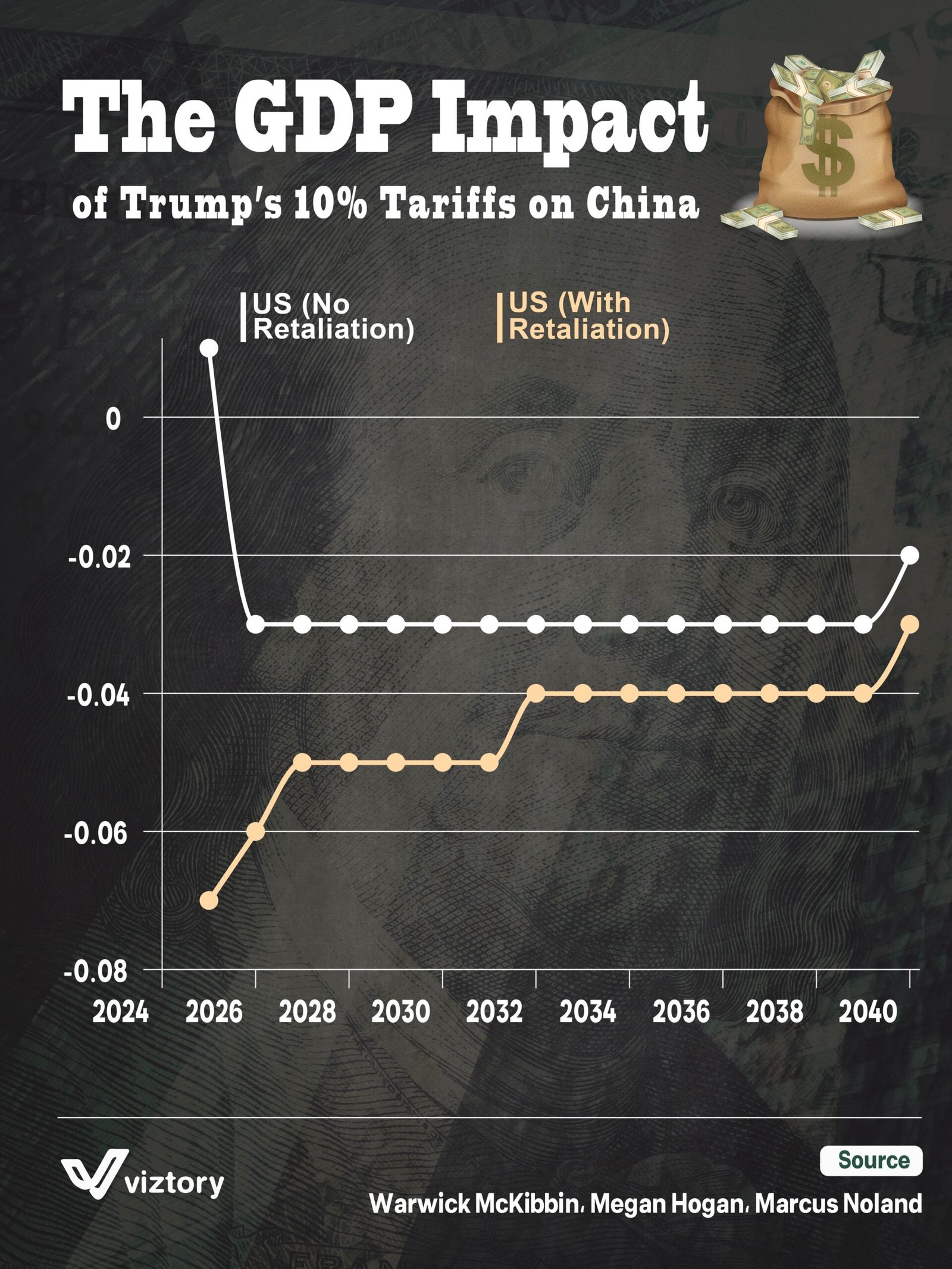

Trade policies don’t just shift supply chains—they reshape entire economies. The image above, crafted by Viztory and based on analysis from Warwick McKibbin, Megan Hogan, and Marcus Noland, visualizes the long-term GDP effects on the United States resulting from Trump’s 10% tariffs on China. It splits the impact into two scenarios: with Chinese retaliation and without.

In both cases, the trend is clear: money doesn’t like uncertainty or retaliation. This chart shows how protectionist policies, while seemingly patriotic in the short term, may quietly drain national wealth over decades.

Understanding the Scenarios

➤ US (No Retaliation)

-

The white line represents GDP performance if China does not retaliate.

-

There’s an immediate decline post-2024, followed by a mild and stagnant drop hovering just below 0% into the 2040s.

-

Even without retaliation, the U.S. GDP consistently underperforms its potential baseline, indicating tariffs alone cause financial leakage.

➤ US (With Retaliation)

-

The orange line paints a more dramatic picture.

-

A steep decline begins in 2025, bottoming around -0.065% by 2027.

-

Though there is a slight upward correction around 2033, it never reaches the “no retaliation” scenario—showing long-term structural harm when global money flows are obstructed.

Money at the Heart of the Matter

Trade wars are not waged with bullets—they’re fought with supply chains, tariffs, and investor confidence. This chart quantifies:

-

GDP losses as opportunity cost—what the U.S. economy could have gained without distortion.

-

The fear-driven exit of capital when policies provoke retaliation.

-

How policy uncertainty delays investment and productivity improvements.

In money terms, even a 0.05% drag on U.S. GDP annually translates to hundreds of billions of dollars in lost output over 15+ years.

Key Insights

1. Tariffs Hurt the Initiator

Even without retaliation, U.S. companies face higher import costs, consumers deal with inflated prices, and exporters suffer from foreign pushback.

2. Retaliation Is Economically Punitive

When China strikes back, the compounding losses over time nearly double. These effects reach beyond manufacturing—into agriculture, retail, tech, and logistics.

3. Policy Certainty = Financial Stability

Markets love predictability. The fluctuating trajectory after 2025 signals investor hesitation, business model rewiring, and loss of trade confidence.

Long-Term Impact on Growth and Investment

Tariffs can:

-

Shift production to costlier regions (reducing margins)

-

Disrupt global supply chains (raising overhead)

-

Lead to currency volatility and bond market shifts

-

Force businesses to delay capital expenditure

Ultimately, these consequences slow national economic momentum, compounding annually into trillions of dollars lost.

Final Thoughts

The chart is a clear warning sign: using tariffs as leverage in global politics may seem effective short term—but money speaks louder than ideology in the long run. Whether or not China retaliates, the American economy absorbs the cost.

Smart policymaking means evaluating trade tools not just for their political popularity, but for their economic consequences measured in GDP points and billions of dollars.

In the war over tariffs, the silent casualty is sustained national prosperity.