Asia’s Economic Giants: Top GDP Leaders in 2025

Introduction

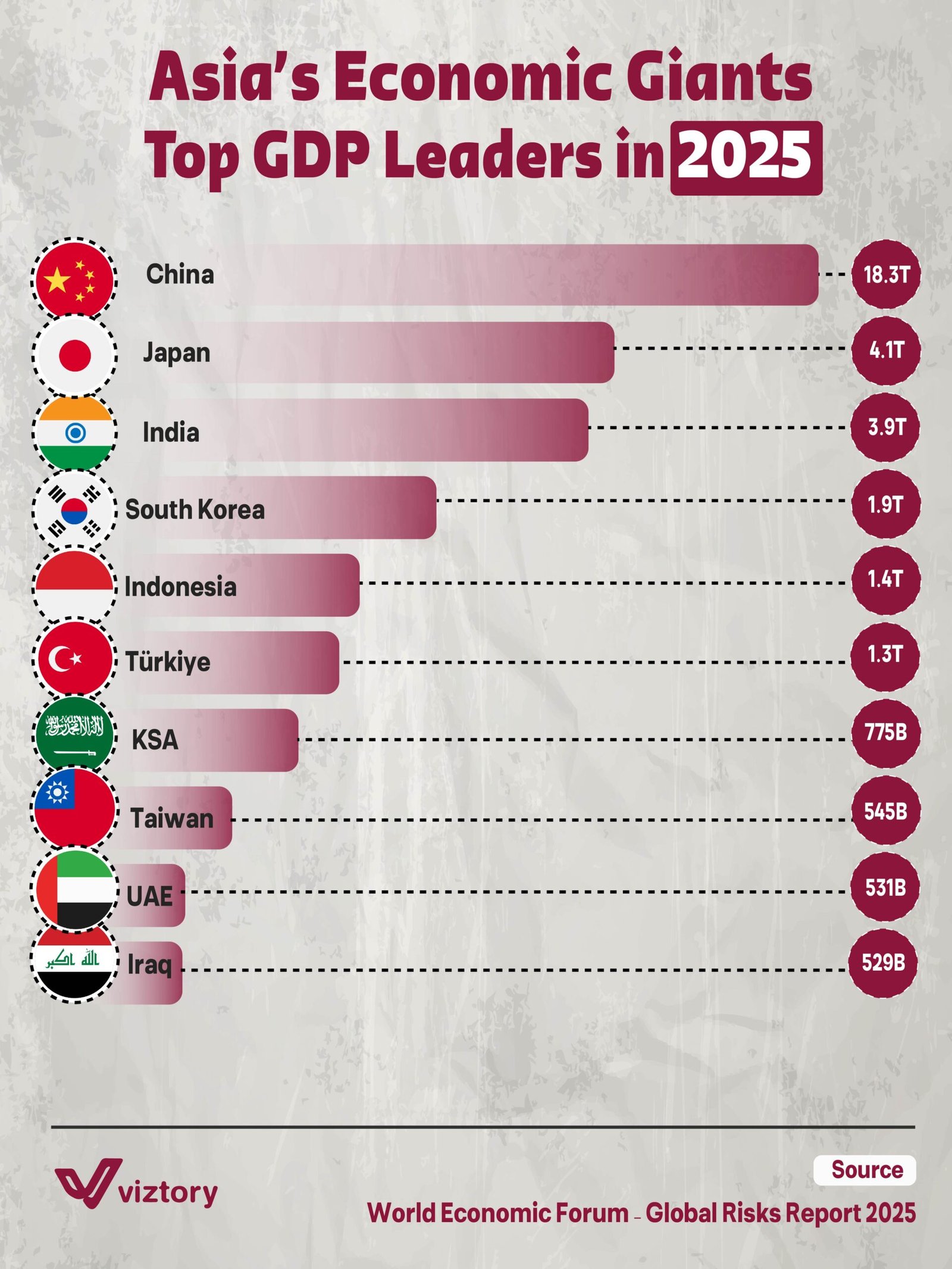

The Asian economic landscape has undergone a dramatic transformation over the past few decades. In 2025, the continent’s financial powerhouses continue to reshape global trade, innovation, and investment. The chart provided by Viztory, using data from the World Economic Forum – Global Risks Report 2025, ranks the top 10 Asian countries by GDP, underscoring each nation’s output in trillions or billions of USD.

Behind each figure is a deeper narrative of money—how it’s made, where it flows, and what it drives.

GDP Rankings at a Glance

Here are the leading Asian economies by GDP in 2025:

| Rank | Country | GDP (USD) |

|---|---|---|

| 1️⃣ | China | $18.3T |

| 2️⃣ | Japan | $4.1T |

| 3️⃣ | India | $3.9T |

| 4️⃣ | South Korea | $1.9T |

| 5️⃣ | Indonesia | $1.4T |

| 6️⃣ | Türkiye | $1.3T |

| 7️⃣ | Saudi Arabia | $775B |

| 8️⃣ | Taiwan | $545B |

| 9️⃣ | UAE | $531B |

| 🔟 | Iraq | $529B |

Where Money Meets Momentum

China: The Indisputable Giant

China towers above its peers with a GDP of $18.3 trillion—more than four times the next economy on the list. Fueled by manufacturing, digital exports, and infrastructure spending, China is leveraging its size to dominate global supply chains.

🇯🇵 Japan: Mature, Yet Mighty

Though Japan’s growth has slowed, its $4.1 trillion economy still holds second place. With strength in automotive, robotics, and electronics, Japan remains a stable pillar of investment and technological leadership.

🇮🇳 India: The Emerging Superpower

Close behind Japan, India is surging with $3.9 trillion in GDP. Rapid digitization, a booming middle class, and startup-friendly reforms have turned India into a global money magnet for venture capital and FDI.

Rising Economies Worth Watching

-

South Korea ($1.9T): A model of innovation and high-tech exports.

-

Indonesia ($1.4T): Rich in resources and digital adoption, gaining investor trust.

-

Türkiye ($1.3T): Strategically bridging Asia and Europe, with strong manufacturing sectors.

These countries are increasingly seen as diversification zones for international portfolios, especially as supply chains shift post-COVID and amid geopolitical tensions.

The Role of Oil and Policy

Gulf States: Fueling GDP Through Petroleum

-

Saudi Arabia ($775B), UAE ($531B), and Iraq ($529B) derive substantial revenue from energy exports.

-

However, diversification efforts—like Vision 2030—aim to reposition these countries as financial and tourism hubs.

Taiwan: Tech Capital on the Rise

With $545B GDP, Taiwan is the heartbeat of the global semiconductor supply chain. Its influence far outweighs its size—making it essential to the flow of global digital money.

Analysis: Economic Implications for Investors

-

China and India are shaping up to be the dominant markets for long-term capital.

-

Japan and South Korea offer stable returns, driven by advanced technology.

-

Southeast Asia and Gulf nations present high-risk, high-reward scenarios tied to political reform, energy prices, and regional stability.

The smart money is spreading across these regions—not just chasing GDP size, but aligning with innovation, youth demographics, digital infrastructure, and trade policies.

Conclusion

The economic hierarchy of Asia in 2025 shows a mix of traditional powerhouses and rising disruptors. GDP isn’t just a number—it’s a reflection of money’s movement, concentration, and momentum. For policymakers, investors, and analysts, this chart isn’t a static summary—it’s a dynamic invitation to engage, invest, and innovate in the new centers of economic gravity.

As the global economy pivots increasingly eastward, the countries on this list aren’t just GDP leaders—they are strategic beacons for the next wave of global prosperity.