Debt Burden of Major Nations in 2024

-

Oct, Fri, 2024

Debt Burden of Major Nations in 2024: Financial Implications for Global Stability

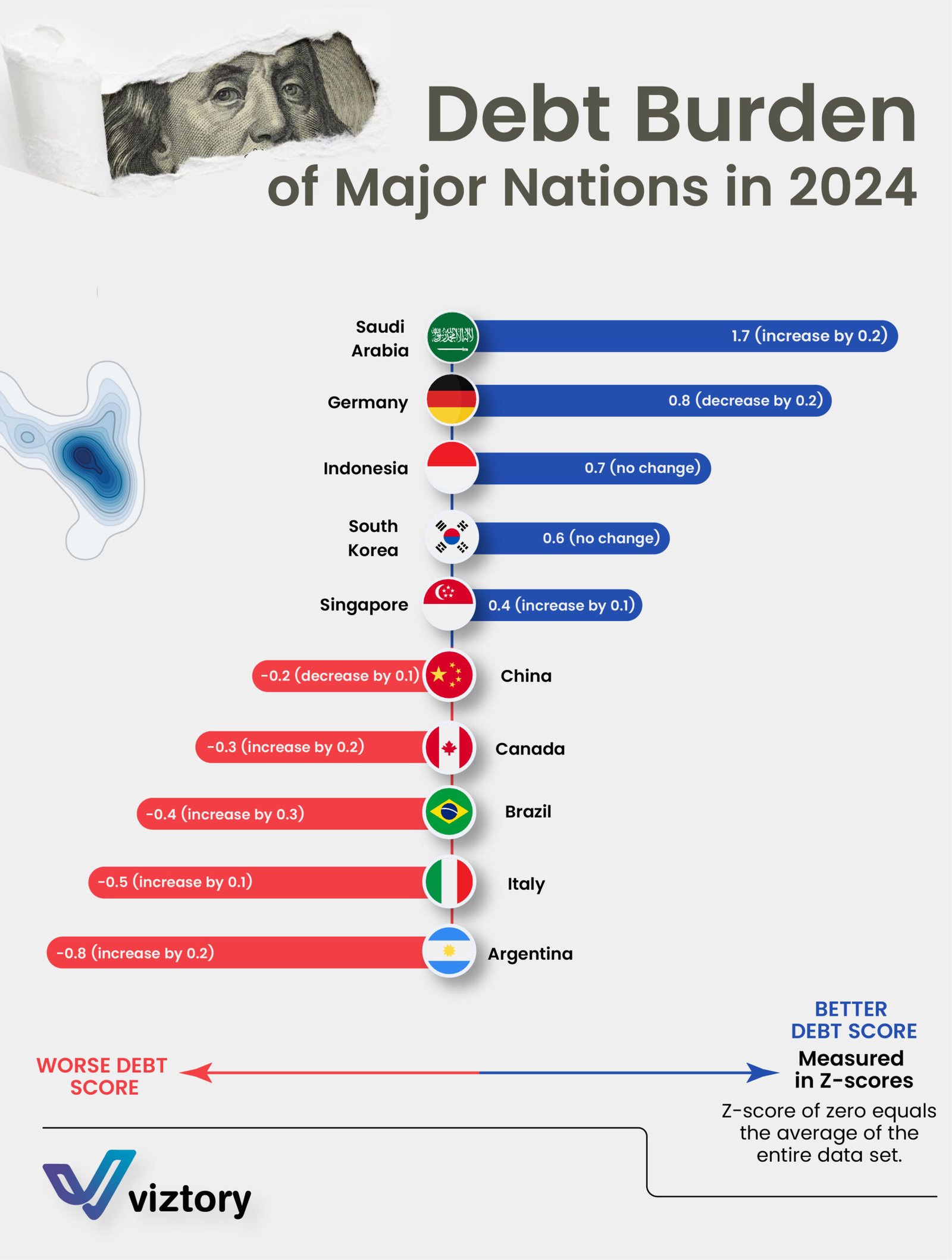

The visualization depicts the debt burden of major countries in 2024, measured by Z-scores. Saudi Arabia shows the highest debt score at 1.7, while Argentina holds the lowest at -0.8. Changes in debt burden, indicated by increases or decreases in Z-scores, reflect economic shifts that impact financial stability, investor confidence, and global markets. Understanding these dynamics is crucial for assessing economic health and making informed financial decisions in an interconnected global economy.

Rising Debt Burdens and Economic Impact

Countries like Saudi Arabia and Singapore with positive debt scores are managing debt levels above the average. Saudi Arabia’s increase by 0.2 suggests growing obligations, potentially due to investment in economic diversification and infrastructure. While these investments can stimulate growth, they also pose risks, especially if they lead to higher debt servicing costs. For investors, understanding a country’s debt burden is essential, as excessive debt can lead to inflationary pressures, currency devaluation, and increased borrowing costs.

Debt Reduction Strategies and Fiscal Health

On the other hand, Germany has reduced its debt score to 0.8, indicating fiscal consolidation and prudent debt management. Debt reduction strategies can strengthen a nation’s economic resilience, making it more attractive to investors seeking stable environments. Countries like China, with a slight decrease in debt score, may be focusing on debt sustainability, aiming to balance growth while managing debt risks. These countries benefit from lower borrowing costs and enhanced credit ratings, which positively influence their financial markets and currency stability.

Implications of Worsening Debt Scores

Countries with worsening debt scores, such as Canada (increased to -0.3) and Brazil (-0.4), face challenges that may strain their economies. Increased debt burdens can lead to fiscal constraints, limiting public spending on essential services like healthcare and education. For businesses operating in these regions, understanding debt levels helps assess risks related to potential tax hikes or cuts in public investments, which could impact consumer spending and economic growth.

Managing Debt in Emerging Economies

Emerging economies like Indonesia and South Korea maintain moderate debt scores with no significant changes. These countries often balance growth aspirations with debt management to avoid falling into unsustainable debt traps. For countries like Argentina, with the lowest debt score (-0.8) and an increase by 0.2, addressing high debt levels is critical for achieving financial stability. Such countries may need international assistance, structural reforms, and fiscal discipline to improve their economic outlook and avoid defaults.

Conclusion

The debt burden of major nations provides insight into their financial stability and economic policies. Countries with high and increasing debt levels may face economic risks, while those successfully managing or reducing debt can position themselves as stable investment destinations. As global markets remain interconnected, understanding debt trends helps investors, policymakers, and businesses navigate risks and capitalize on opportunities in both stable and emerging economies. By managing debt responsibly, nations can ensure sustainable growth, maintain financial resilience, and foster global economic stability.