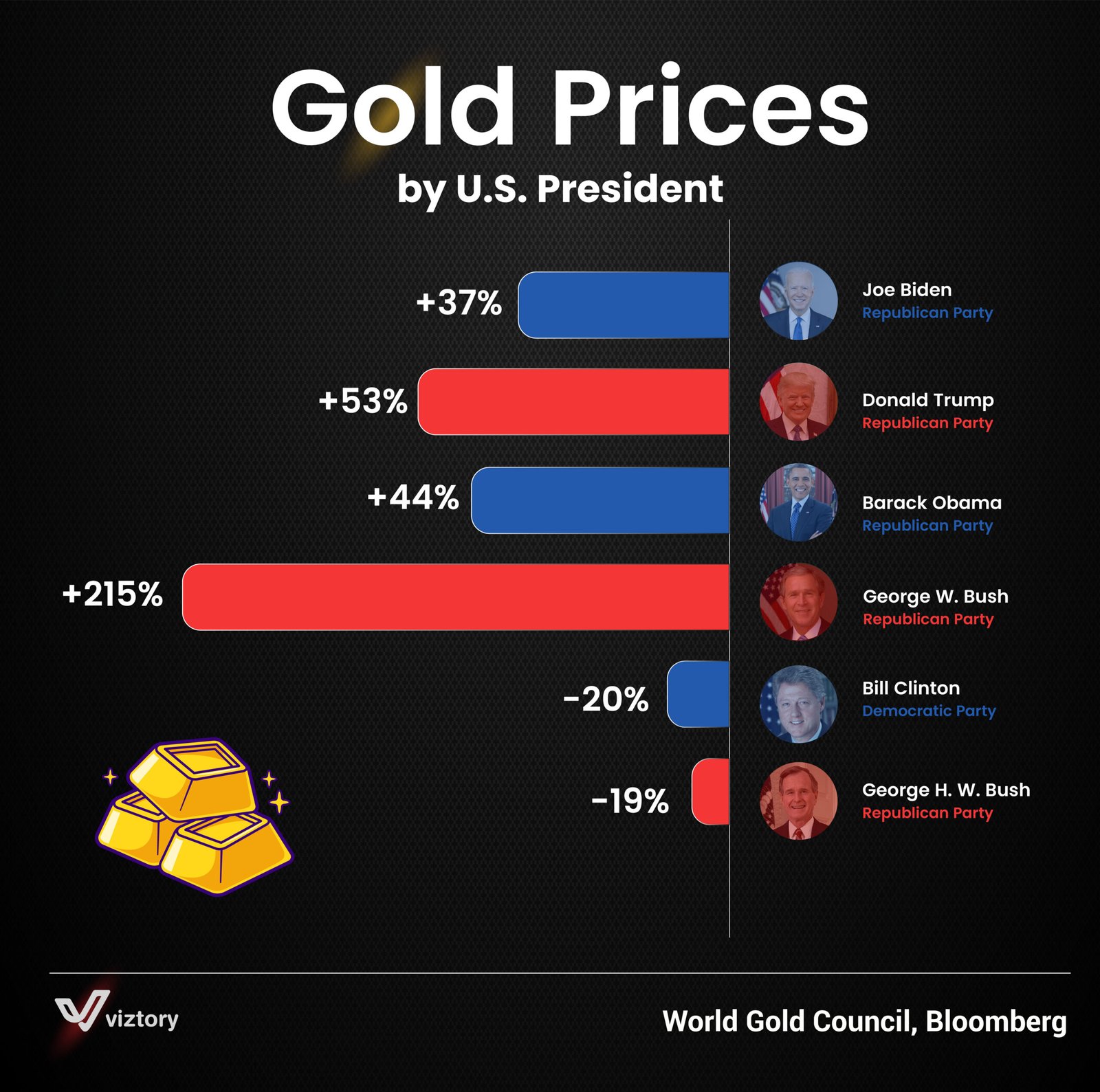

Gold Prices by U.S. President

-

Sep, Thu, 2024

Gold Prices by U.S. President

This chart presents the percentage change in gold prices during the presidencies of several U.S. presidents, illustrating how gold values have fluctuated under different administrations. Gold, as a traditional store of value and a hedge against economic instability, has long been influenced by various factors, including economic policies, global markets, and political climates. This relationship between the U.S. presidency and gold prices highlights the broader context of money management, market reactions, and economic stability.

Gold and Economic Stability

Gold is often seen as a safeguard during times of financial uncertainty. When economic conditions are unstable or when inflation is a concern, investors tend to flock towards gold as a safe investment. The data shows significant variations in gold prices under different U.S. presidents, reflecting the changing dynamics of the U.S. and global economy during each administration.

-

Joe Biden (Democratic Party): During Biden’s presidency, gold prices increased by +37%. This rise can be attributed to concerns over inflation and market volatility post-pandemic, as well as the global economic impact of rising interest rates and geopolitical tensions.

-

Donald Trump (Republican Party): Under Trump, gold prices surged by +53%, possibly driven by trade wars, global instability, and economic uncertainty during his tenure, particularly the volatility seen in markets during the COVID-19 pandemic’s onset.

-

Barack Obama (Democratic Party): Gold prices saw a +44% increase during Obama’s presidency, likely reflecting the economic recovery period following the global financial crisis of 2008 and concerns over inflationary pressures during his first term.

-

George W. Bush (Republican Party): Gold experienced a massive +215% increase during Bush’s presidency, which spanned a period of major economic instability, including the aftermath of the 9/11 attacks, the wars in Afghanistan and Iraq, and, most notably, the 2008 financial crisis. Investors sought gold as a safe haven amid these uncertainties.

-

Bill Clinton (Democratic Party): In contrast, under Clinton, gold prices dropped by -20%. The 1990s were a period of economic prosperity, marked by a booming stock market and strong economic growth, which likely reduced investor interest in gold as an asset.

-

George H. W. Bush (Republican Party): Gold prices also fell by -19% during the tenure of George H. W. Bush, reflecting a more stable global economy at the time compared to later periods.

Money, Gold, and Policy

The fluctuation of gold prices under different presidents is an indicator of broader economic trends. Gold tends to rise during times of fiscal uncertainty, geopolitical conflicts, or monetary policy shifts. For instance, during the presidencies marked by wars or financial crises, such as George W. Bush’s, we see significant increases in gold prices. Meanwhile, during more stable economic periods, as in the case of Clinton, gold prices dropped as confidence in the economy grew.

Gold, while traditionally viewed as a hedge against inflation and economic turmoil, also reflects market perceptions of U.S. monetary policy. When policies favor growth and stability, interest in gold might wane in favor of other investment vehicles. Conversely, when uncertainty or inflation looms, gold becomes a preferred store of value.

Conclusion

Gold prices have fluctuated dramatically depending on the political and economic environment of each presidency, illustrating the complex relationship between money, market confidence, and economic policy. By examining gold prices under different U.S. presidents, we can gain insight into how global events and domestic policies impact investor behavior and financial stability. Gold remains a key asset in the broader financial system, continuously shaped by the evolving nature of money and governance.