Growth in U.S. Natural Gas Exports

-

Oct, Fri, 2024

Growth in U.S. Natural Gas Exports: Economic and Trade Implications

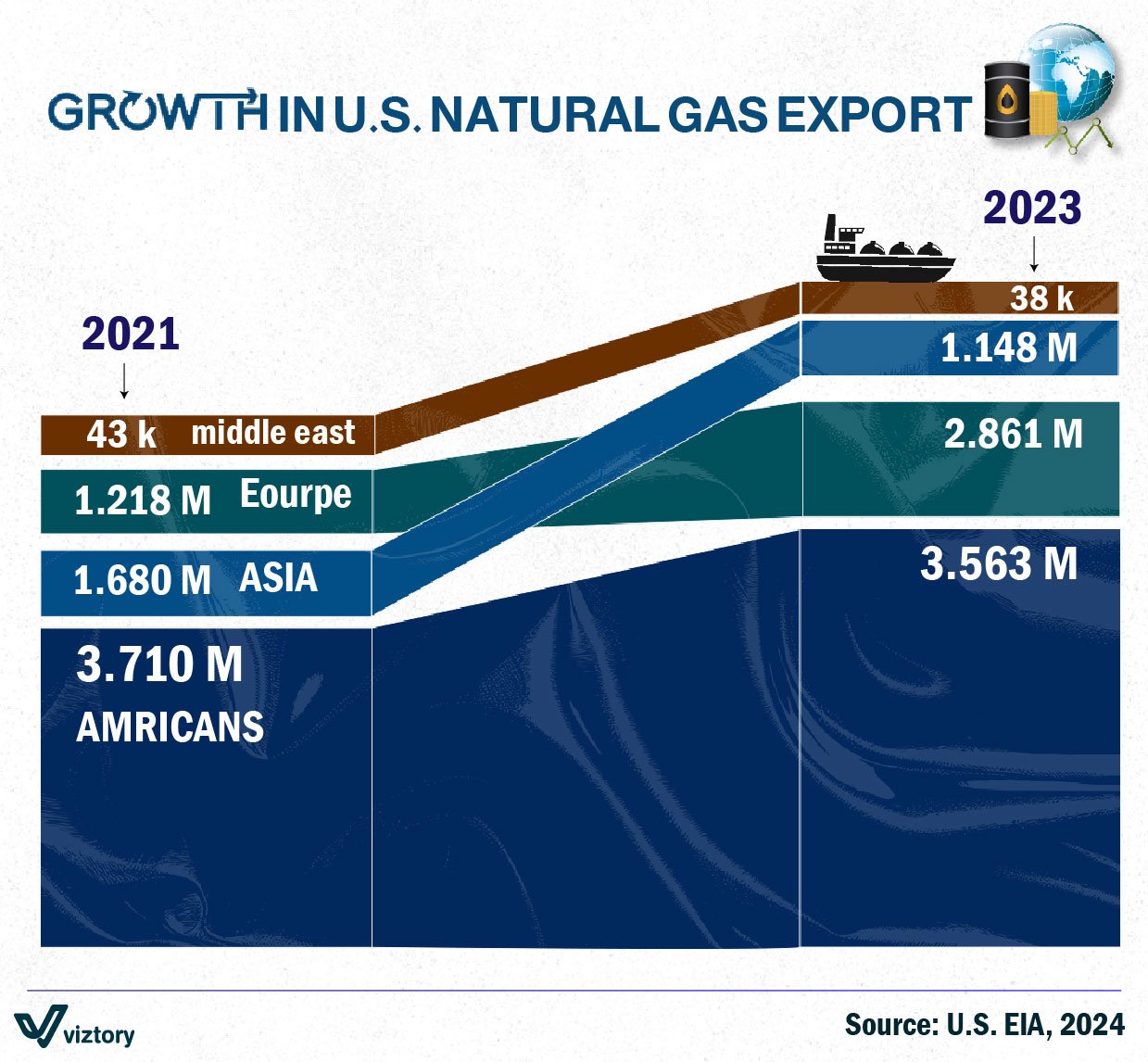

The growth in U.S. natural gas exports between 2021 and 2023, as depicted in the visualization, reflects a significant shift in global energy trade. In 2021, U.S. natural gas exports were relatively modest, with major exports directed toward the Americas, Europe, and Asia. By 2023, these figures had grown substantially, driven by increasing demand from Asia, Europe, and other regions. This growth plays a critical role in shaping both the U.S. economy and the global trade landscape.

Economic Implications of Natural Gas Export Growth

The surge in U.S. natural gas exports contributes directly to the national economy by increasing revenue from one of the world’s most in-demand energy resources. Natural gas production in the U.S. has skyrocketed over the past decade, thanks to advances in hydraulic fracturing (fracking) and horizontal drilling technologies, which have unlocked vast reserves of shale gas. This increase in production has positioned the U.S. as a leading exporter of liquefied natural gas (LNG).

For the U.S. economy, this export growth translates into several benefits:

- Job Creation: The expansion of the natural gas industry supports job growth in sectors like extraction, infrastructure development, and transportation.

- Trade Balance: By exporting more natural gas, the U.S. is able to reduce its trade deficit with major energy-importing regions such as Asia and Europe.

- Government Revenue: Increased exports lead to higher tax revenues and royalties for local, state, and federal governments, boosting public finances.

U.S. Natural Gas Exports by Region

As shown in the visualization, the major regions importing U.S. natural gas in 2023 include:

- The Americas: The U.S. continues to supply a significant amount of natural gas to its neighboring countries, though exports slightly decreased from 3.71 million in 2021 to 3.563 million in 2023.

- Asia: Asian countries, particularly energy-hungry economies like Japan, South Korea, and China, have increased their reliance on U.S. LNG. U.S. exports to Asia grew from 1.68 million in 2021 to 2.861 million in 2023, reflecting rising demand in these fast-growing economies.

- Europe: The ongoing energy transition and geopolitical factors, such as the war in Ukraine and the shift away from Russian energy supplies, have driven up demand for U.S. natural gas in Europe. In 2023, Europe imported 1.148 million units of U.S. natural gas, a slight decrease from 1.218 million in 2021, but still a substantial figure.

- The Middle East: Exports to the Middle East remain modest, with 38,000 units in 2023, reflecting the region’s own substantial natural gas resources and lower reliance on imports.

Impact on Global Energy Trade

The rapid growth in U.S. natural gas exports has altered global energy trade flows. As the U.S. becomes a major supplier of LNG, traditional energy exporters such as Russia and the Middle East are seeing increased competition in key markets like Asia and Europe. For instance, European countries that once relied heavily on Russian natural gas have shifted toward U.S. LNG to diversify their energy supplies and reduce dependence on a single source.

Additionally, the ability of the U.S. to export large volumes of natural gas gives it leverage in international energy diplomacy. Countries that rely on U.S. gas imports may form stronger economic and geopolitical ties with the U.S., enhancing its influence on the global stage.

Environmental and Energy Transition Considerations

While natural gas is considered a cleaner fossil fuel compared to coal and oil, its expansion raises questions about its role in the global energy transition. Many countries are seeking to reduce carbon emissions by investing in renewable energy sources like solar and wind. However, natural gas, as a lower-emission alternative to coal, is seen as a “bridge fuel” that can help smooth the transition to a low-carbon future.

In this context, the U.S. is well-positioned to supply natural gas to countries that are phasing out coal while gradually building up renewable energy capacity. Nevertheless, there are environmental concerns about methane emissions from natural gas extraction and transport, which could undermine global efforts to mitigate climate change if not adequately addressed.

Trade Relations and Geopolitical Dynamics

The growth in U.S. natural gas exports has important implications for trade relations and geopolitics. As the U.S. increases its LNG exports to Europe and Asia, it becomes a key player in ensuring global energy security. This newfound influence allows the U.S. to play a strategic role in reducing Europe’s energy dependence on Russia, which has been a critical geopolitical goal for both the U.S. and the European Union.

Moreover, the growth in natural gas exports to Asia, particularly China, reflects how energy trade can facilitate economic partnerships between the two largest global economies, even in the context of trade tensions and strategic competition. These exports enhance interdependence between the U.S. and major Asian economies, creating potential leverage in economic and political negotiations.

Conclusion: Natural Gas as an Economic and Strategic Asset

The growth of U.S. natural gas exports from 2021 to 2023 demonstrates how energy resources can serve as a powerful economic and strategic asset. With increasing demand from key regions such as Asia and Europe, U.S. natural gas exports contribute to national economic growth, job creation, and trade balance improvements. At the same time, they strengthen the U.S.’s role in global energy markets and enhance its geopolitical influence.

As the world continues to transition toward a more sustainable energy future, natural gas will remain a crucial component of the energy mix, particularly for countries looking to reduce emissions while maintaining economic growth. For the U.S., the challenge will be to continue capitalizing on its natural gas wealth while also contributing to global efforts to mitigate climate change.