Impact of U.S. Port Strikes on Major Companies

-

Oct, Mon, 2024

Impact of U.S. Port Strikes on Major Companies: Implications for Economic Stability

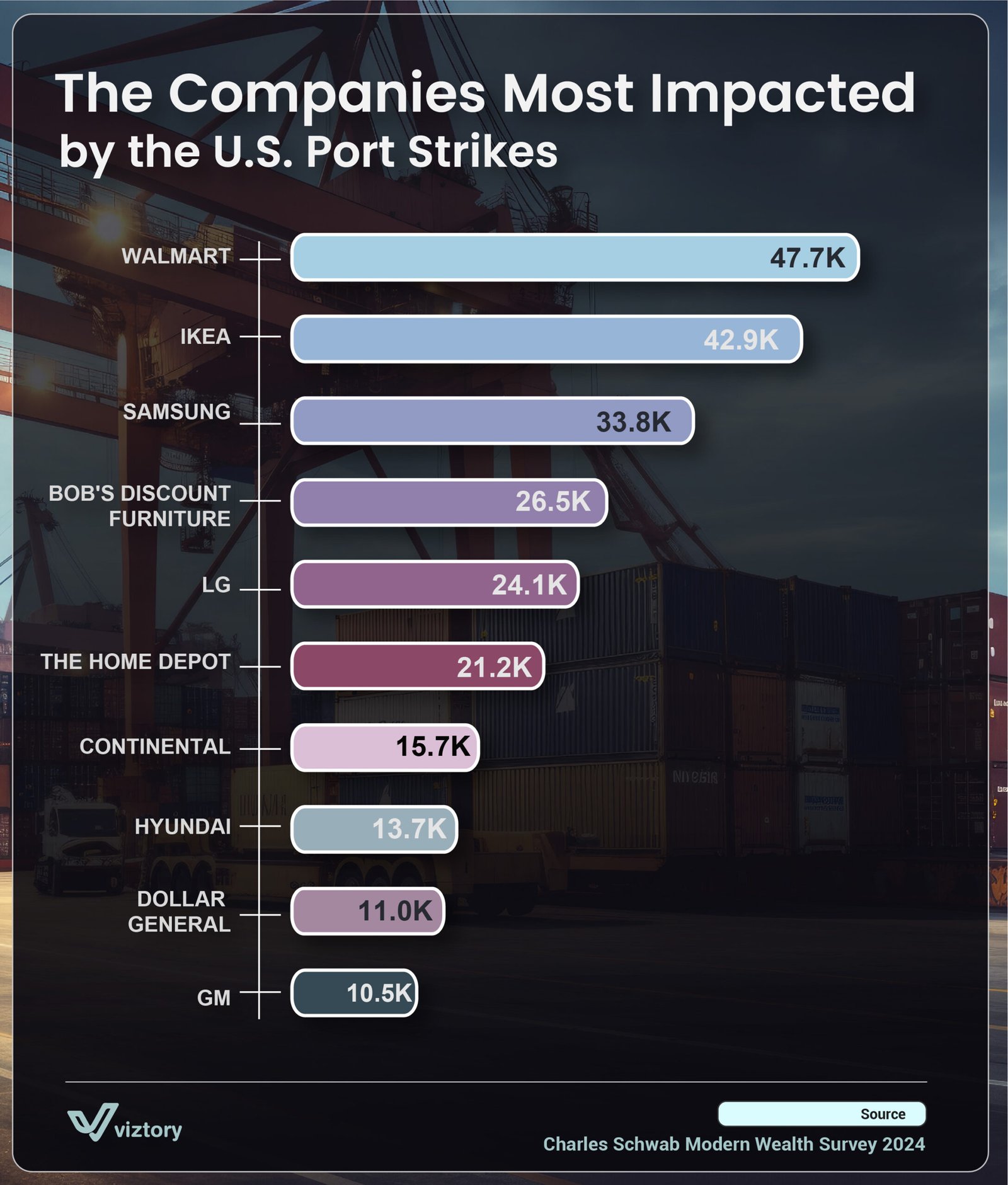

The U.S. port strikes have caused significant disruptions for various companies, highlighting vulnerabilities within the global supply chain. The visualization depicts the impact on major companies, with Walmart, IKEA, and Samsung topping the list. These disruptions underscore the interconnected nature of global trade and the critical role that supply chains play in maintaining economic stability.

Disrupted Supply Chains and Economic Consequences

With Walmart experiencing the highest impact at 47.7K (likely units delayed or affected), followed closely by IKEA (42.9K) and Samsung (33.8K), the ripple effects of these disruptions are felt across multiple sectors, from retail to electronics. Such delays not only affect product availability but also lead to increased costs and lost revenue, which can strain economic growth. For businesses and investors, understanding these disruptions is essential for evaluating risks in an interconnected economy where supply chain issues can lead to inflationary pressures and influence consumer spending.

Sector-Specific Impacts and Market Adaptation

Companies like Bob’s Discount Furniture and The Home Depot, with 26.5K and 21.2K units impacted, respectively, are facing challenges that could lead to changes in inventory strategies and sourcing practices. These sectors may need to adapt by diversifying suppliers, increasing inventory levels, or investing in logistics improvements to mitigate future risks. For example, the retail sector may experience price hikes due to increased transportation costs, affecting consumer purchasing power and potentially leading to a slowdown in economic activity.

Navigating Economic Risks and Maintaining Stability

Companies such as Continental and Hyundai, with impacts of 15.7K and 13.7K units respectively, illustrate the challenges faced by the automotive industry, which relies heavily on timely delivery of parts and components. Supply chain disruptions can lead to production slowdowns, increased costs, and challenges in meeting demand. As companies navigate these risks, they must balance the need for operational efficiency with the demand for resilient supply chains.

Strategic Responses and Long-Term Outlook

The financial repercussions extend beyond immediate losses. Companies like Dollar General and GM, with impacts of 11.0K and 10.5K units, respectively, are smaller players on this list but still face significant challenges. Their response to these strikes may involve revisiting supply chain strategies, exploring alternative logistics options, or even adjusting their market strategies. A well-managed response can mitigate some negative impacts, while long-term solutions may involve reshaping supply chain networks to enhance resilience.

Conclusion

The U.S. port strikes serve as a stark reminder of the importance of resilient supply chains in a globalized economy. For companies, investors, and policymakers, understanding these dynamics is critical for assessing economic stability and making informed decisions. As companies adapt to these disruptions, the global economy will continue to evolve, highlighting the need for flexibility and strategic planning to ensure sustainable growth and maintain financial resilience in the face of unexpected challenges.