Wealth Inequality Changes

-

Oct, Fri, 2024

Wealth Inequality Changes: A Financial Divide Deepening Across Nations

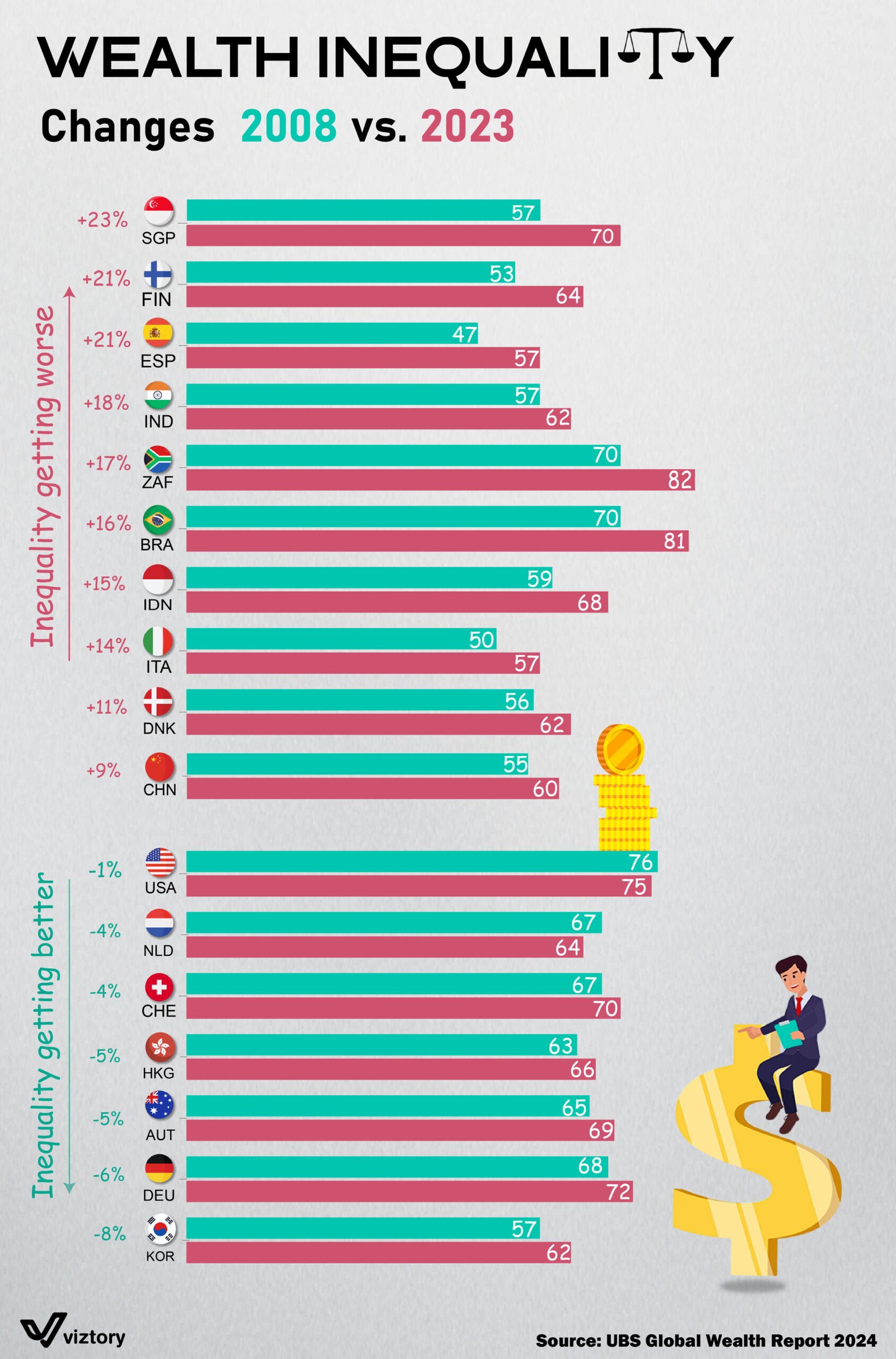

The global landscape of wealth inequality has shifted significantly from 2008 to 2023, as represented in the visual data above. While some countries have seen improvements in wealth distribution, others have experienced a stark rise in inequality. This article examines these changes, exploring their broader implications in terms of money, wealth concentration, and economic disparities.

Wealth Inequality Worsening in Key Nations

The visualization highlights that several countries have experienced significant increases in wealth inequality between 2008 and 2023. Singapore (+23%), Finland (+21%), and Spain (+21%) are at the forefront of this trend, with substantial growth in wealth disparity. These increases point to a growing concentration of wealth among a small segment of the population, leaving a vast majority struggling with stagnant wages and limited upward mobility.

Singapore: An Economic Powerhouse with Rising Inequality

Singapore’s 23% increase in wealth inequality is particularly striking, given its status as one of the world’s most advanced financial hubs. While Singapore’s economic growth has lifted many out of poverty, a widening gap between the ultra-wealthy and the rest of the population underscores the limitations of rapid economic expansion without addressing wealth redistribution.

Singapore’s financial policies, focused on attracting global businesses and fostering wealth accumulation through investments, have contributed to the rise in inequality. This accumulation of wealth among the top 1% has fueled the real estate boom and driven the cost of living higher, impacting the middle and lower classes. This raises critical questions about the sustainability of wealth concentration and the need for more inclusive financial policies.

India and South Africa: Emerging Economies with Widening Gaps

India (+18%) and South Africa (+17%) are other key nations showing a troubling rise in inequality. India, one of the world’s fastest-growing economies, has seen explosive wealth growth among its upper classes, but this growth has not been distributed evenly. The majority of the population, especially in rural areas, continues to face financial challenges, with limited access to education, healthcare, and financial resources. The rise in inequality in India indicates that economic growth alone is not enough to bridge the gap between the rich and the poor without significant policy reforms.

South Africa, long burdened by historical economic inequality, remains one of the most unequal societies globally. The gap between the wealthy and the impoverished continues to widen, reflecting persistent unemployment, limited social mobility, and an uneven distribution of resources.

The Economics of Wealth Accumulation: Who Gains?

The countries at the top of this list reflect the broader global trend of wealth accumulation concentrating among the already wealthy. This pattern is driven by a variety of factors, including financialization, tax policies favoring capital gains over income, and the globalization of business.

Money in these countries tends to flow upwards due to the increased value of assets such as real estate, stocks, and corporate profits. The wealthy have more access to investment opportunities and financial instruments that multiply their wealth over time, further exacerbating the divide between the rich and the poor. Meanwhile, those without significant capital are left with fewer opportunities for wealth generation, perpetuating the cycle of inequality.

Wealth Inequality Improving in Some Nations

While many countries are grappling with rising inequality, the visualization also highlights nations where wealth inequality has improved. South Korea (-8%), Germany (-6%), and Austria (-5%) are among the countries that have managed to reduce the wealth gap over the past decade.

South Korea: A Success Story in Wealth Distribution

South Korea’s 8% improvement in wealth inequality is a testament to its robust economic policies aimed at fostering equitable growth. The country has invested heavily in education, technology, and infrastructure, ensuring that the benefits of economic development are shared across different social strata. South Korea’s progressive taxation system and social welfare programs have helped narrow the wealth gap, allowing for more balanced economic participation.

Germany and Austria: European Models of Economic Stability

Germany (-6%) and Austria (-5%) have long been seen as models of economic stability, with strong labor protections, social safety nets, and healthcare systems that support the middle class. Their reductions in inequality reflect the success of policies that promote wealth distribution through progressive taxation, social services, and access to education and healthcare. These countries prioritize social cohesion and the economic well-being of their citizens, leading to lower levels of inequality compared to more market-driven economies.

The Role of Money in Shaping Wealth Disparities

Money plays a central role in shaping wealth inequality. Access to financial resources, investment opportunities, and economic networks is often reserved for those with significant capital, creating barriers for lower-income individuals. As wealth accumulates among the top earners, the gap between the rich and poor widens, exacerbating social tensions and limiting economic mobility.

In countries like the United States and China, where wealth inequality has either slightly improved or remained stagnant, the issue of wealth concentration remains pressing. While the U.S. has seen a 1% reduction in inequality, it continues to grapple with systemic wealth disparities, particularly regarding race and income. Similarly, China’s 9% increase in inequality reflects its ongoing struggle to balance rapid economic growth with fair wealth distribution.

Conclusion: A Global Call for Equitable Financial Systems

The wealth inequality trends from 2008 to 2023 highlight the global financial divide that persists despite economic growth. While some nations have made strides in reducing inequality, the overall picture suggests that more needs to be done to ensure that wealth generation benefits all citizens, not just the elite.

Countries that have successfully reduced wealth inequality serve as examples of how targeted financial policies, social welfare programs, and progressive taxation can help create a more equitable distribution of wealth. As the global economy continues to evolve, the challenge will be to design financial systems that promote inclusive growth and address the deep-rooted causes of inequality.