The MAG7: Tech Giants Dominating the U.S.

-

Oct, Fri, 2024

The MAG7: Tech Giants Dominating the U.S. Market and Their Financial Strengths

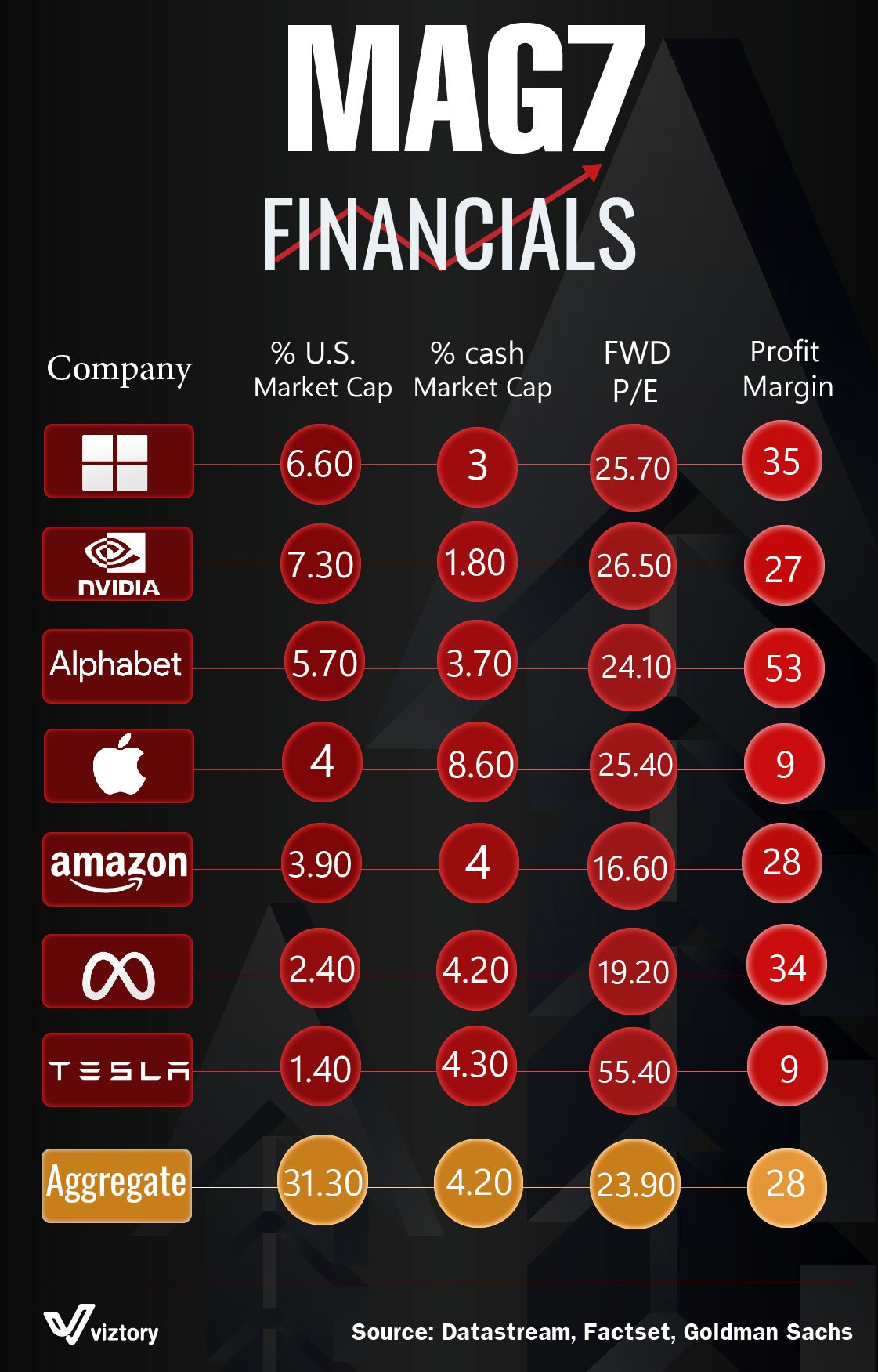

The provided visualization highlights the financial metrics of the “MAG7” (Microsoft, NVIDIA, Alphabet, Apple, Amazon, Meta, and Tesla), showing their dominance in the U.S. market. These seven tech giants are reshaping industries, driving innovation, and shaping the future of technology. Together, they represent a massive 31.3% of the U.S. market capitalization, a reflection of their vast influence. Their ability to command significant market value and maintain strong profit margins demonstrates their crucial role in the global economy. This article explores their financial metrics and technological impact.

Market Cap and Technological Powerhouses

The % of U.S. Market Cap metric reveals the weight of these tech companies in the stock market. NVIDIA leads with a 7.3% market share, followed closely by Microsoft (6.6%) and Alphabet (5.7%). These companies, through their innovations in AI, cloud computing, and digital services, have achieved such dominance by continuously advancing the boundaries of technology.

Microsoft: A Strong Market Leader

Microsoft’s 6.6% of the U.S. market cap is built on its strength in cloud services (Azure), software, and enterprise solutions. With a forward Price-to-Earnings (P/E) ratio of 25.7 and a profit margin of 35%, Microsoft showcases its ability to generate strong profits while maintaining a broad range of offerings. Microsoft’s leadership in AI development, cloud infrastructure, and productivity software continues to fuel its global expansion.

NVIDIA: Driving the AI Revolution

NVIDIA’s 7.3% market cap share reflects its dominance in the semiconductor industry, particularly its role in powering artificial intelligence (AI) and machine learning applications. With a forward P/E of 26.5, NVIDIA is capitalizing on the exponential growth of AI, autonomous vehicles, and graphics processing units (GPUs) for gaming and professional use. Its strong 27% profit margin highlights its ability to maintain profitability while scaling new technological frontiers.

Alphabet: The King of Digital Advertising

With a 5.7% market share, Alphabet, the parent company of Google, remains at the forefront of digital advertising and search technologies. Its forward P/E of 24.1 and impressive profit margin of 53% demonstrate its dominance in the digital ad space and cloud computing (Google Cloud). Alphabet continues to invest heavily in AI research, cloud services, and next-gen technologies like autonomous driving (Waymo), which are critical to its long-term growth strategy.

Profitability and Technological Innovation

Profit margins are a key indicator of financial health, and Alphabet leads the pack with a staggering 53%. This is largely driven by its dominance in online advertising and efficient cloud operations. Meta and Microsoft also boast high profit margins, at 34% and 35% respectively, underscoring the profitability of software, social media, and cloud services in the digital age.

Apple: A Global Consumer Technology Giant

Apple’s 8.6% cash market cap reflects its unparalleled ability to generate cash, making it one of the most cash-rich companies globally. Its strong brand, driven by product ecosystems such as the iPhone, Mac, and wearable devices, keeps its profitability intact, even as it faces increased competition in hardware and services. Apple’s forward P/E of 25.4 and relatively low profit margin of 9% may indicate lower margins on hardware sales but a steady increase in services revenue (such as iCloud and Apple Music) keeps its financials robust.

Amazon and Tesla: Disruptors with Diverging Strategies

Amazon’s forward P/E of 16.6 and profit margin of 28% showcase its leadership in e-commerce and cloud computing (AWS), despite the pressures of running a low-margin retail business. AWS continues to be a cash cow for Amazon, providing much-needed profitability for a company that invests heavily in expansion.

Tesla, on the other hand, has a sky-high forward P/E of 55.4, reflecting its status as a market disruptor in electric vehicles (EVs) and energy storage solutions. While Tesla’s profit margin sits at a modest 9%, its valuation is fueled by future expectations of global EV dominance and advances in autonomous driving technologies.

Cash Reserves: Strength for Future Innovation

Cash reserves are critical for these tech giants to maintain their innovation pace and weather market fluctuations. Apple leads with 8.6% of its market cap in cash, giving it the flexibility to make significant acquisitions, invest in R&D, and return value to shareholders. Meta and Tesla also maintain strong cash positions, at 4.2% and 4.3%, respectively, allowing them to fund their ambitious projects in virtual reality (VR), artificial intelligence, and renewable energy.

Technological Impact and Future Growth

The MAG7 companies are at the heart of global technological advancements, each playing a crucial role in shaping future technologies:

- Microsoft and Amazon dominate cloud infrastructure, providing the backbone for digital transformation across industries.

- NVIDIA leads the AI hardware race, supplying GPUs that power everything from data centers to AI models.

- Alphabet and Meta continue to innovate in AI and machine learning, with significant investments in next-gen technologies like quantum computing and the metaverse.

- Apple remains a leader in consumer technology, while Tesla is pushing forward with innovations in sustainable energy and electric transportation.

Together, these companies are shaping the future of digital economies, artificial intelligence, renewable energy, and more. Their financial strength allows them to continue investing in cutting-edge research, ensuring their leadership positions in global technology.

Conclusion

The MAG7 companies represent the most powerful and innovative firms in the world, with their massive market caps and impressive profit margins indicating their influence. These tech giants are not only driving the U.S. economy but are also setting the stage for future technological breakthroughs. As they continue to innovate in AI, cloud computing, and renewable energy, their financial strength ensures they will remain at the forefront of the global tech landscape for years to come.