THE TITANS OF SOVEREIGN WEALTH$

THE TITANS OF SOVEREIGN WEALTH$

Introduction

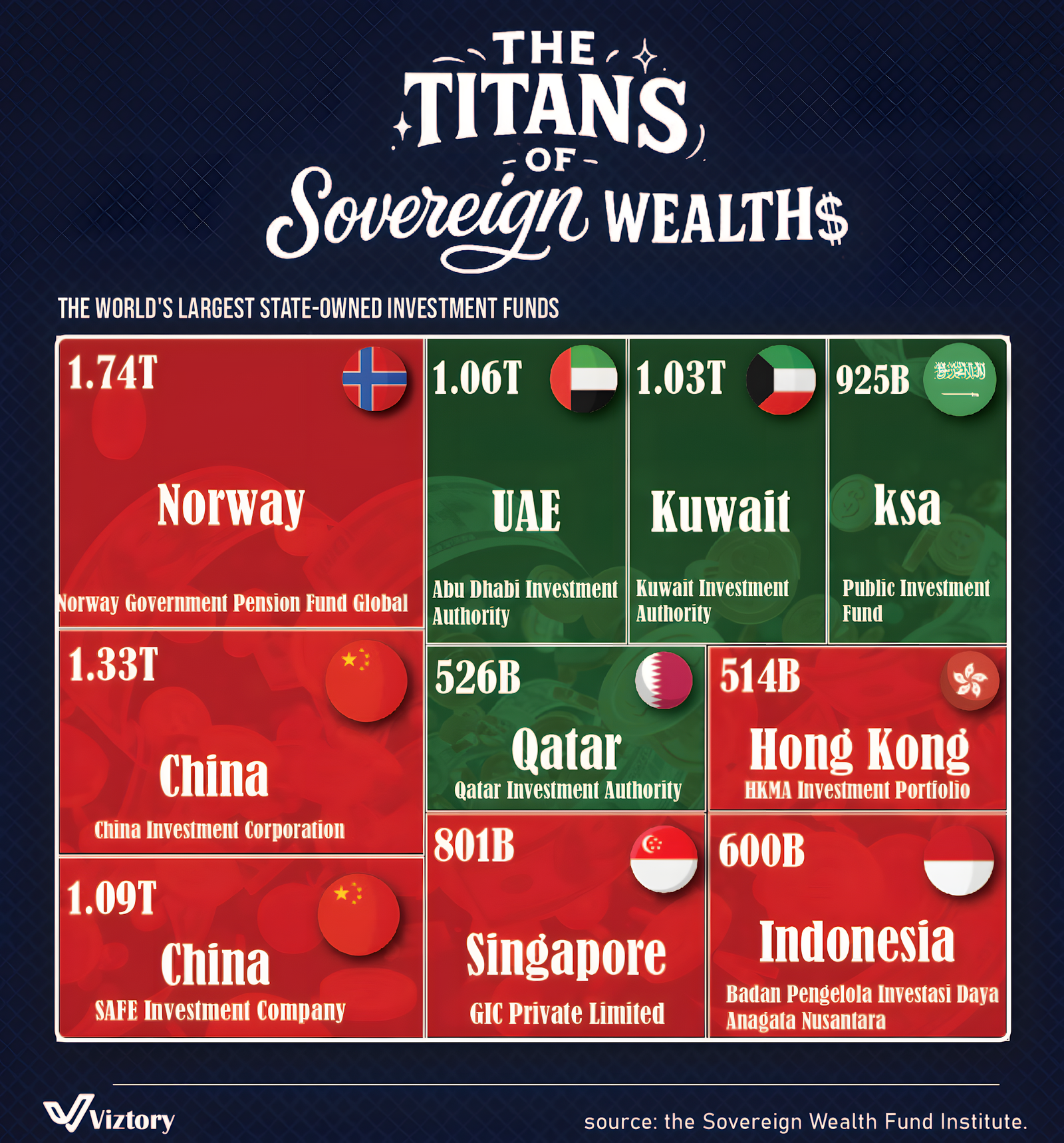

In the modern financial landscape, sovereign wealth funds (SWFs) play a monumental role in shaping global markets, stabilizing national economies, and ensuring intergenerational wealth. The infographic titled “The Titans of Sovereign Wealth$” provides a powerful visual representation of the world’s largest state-owned investment funds, ranked by total assets under management. These funds are managed by countries leveraging surplus revenues—often from oil, trade surpluses, or foreign reserves—channeling them into diversified portfolios for long-term national benefit. This falls squarely under the Money category due to its direct relation to global finance and capital flows.

Key Global Players

Norway: Leading the Pack

At the top of the hierarchy stands Norway, with its Government Pension Fund Global amassing an astonishing $1.74 trillion. Built primarily on oil revenues, Norway’s fund is considered a model of transparency and ethical investment. It is widely recognized for its socially responsible investment policies.

China: A Dual Force

China appears twice in the top ranks:

China Investment Corporation with $1.33 trillion

SAFE Investment Company with $1.09 trillion

These two funds highlight China’s strategic diversification of foreign reserves into global markets, often focusing on infrastructure, tech, and natural resources.

UAE and Kuwait: Gulf Heavyweights

The Abu Dhabi Investment Authority (UAE) and Kuwait Investment Authority each hold assets surpassing $1 trillion. These Gulf nations, heavily reliant on oil exports, have proactively created buffers against volatile oil prices and are investing in sustainable and tech-driven futures.

Regional Analysis: The Middle East in Focus

The Middle East dominates the top ten, with Saudi Arabia ($925B), Qatar ($526B), and others reinforcing the region’s financial muscle. Their funds often invest in international real estate, startups, clean energy, and infrastructure, aligning with their respective Vision 2030 or diversification strategies. These funds are not just investment vehicles; they are geopolitical tools shaping the global order.

Strategic Purpose and Allocation

Different countries have different motivations for building sovereign wealth funds:

Stabilization Funds: Used to buffer economies against commodity price shocks (e.g., oil).

Savings Funds: Intended for future generations (e.g., Norway).

Development Funds: Used to finance economic diversification (e.g., Indonesia, Saudi Arabia).

Their allocations typically span equities, bonds, real estate, infrastructure, and increasingly, tech startups and green energy ventures.

Observations and Trends

Growth of Asian Funds: Notably, Singapore with $801B and Hong Kong with $514B showcase how smaller nations can dominate via strategic investment.

Indonesia’s Rise: With $600B, Indonesia signals a growing trend of emerging economies entering the sovereign wealth space with ambitious mandates.

Tech and ESG Investments: Many of these funds are pivoting toward environmentally and socially responsible investments, as well as tech innovation.

Analysis

The composition of these sovereign wealth funds reflects global economic shifts, resource dependence, and strategic foresight. While oil-rich nations dominate, non-oil countries like Singapore and China have established themselves as investment titans through strategic surplus management. Moreover, these funds influence corporate governance globally, often becoming major shareholders in Fortune 500 companies. Their decisions can sway markets, industries, and even political alliances.

Conclusion

Sovereign wealth funds are not just financial tools—they are instruments of national power, economic resilience, and strategic diplomacy. As global markets become more interconnected, the influence of these “Titans of Sovereign Wealth” will only grow. Their evolution from simple revenue-holding accounts to sophisticated investment entities marks a significant trend in global money management, highlighting the ever-deepening relationship between governance, finance, and global influence.