Top AI Tools by Users (2025)

Introduction

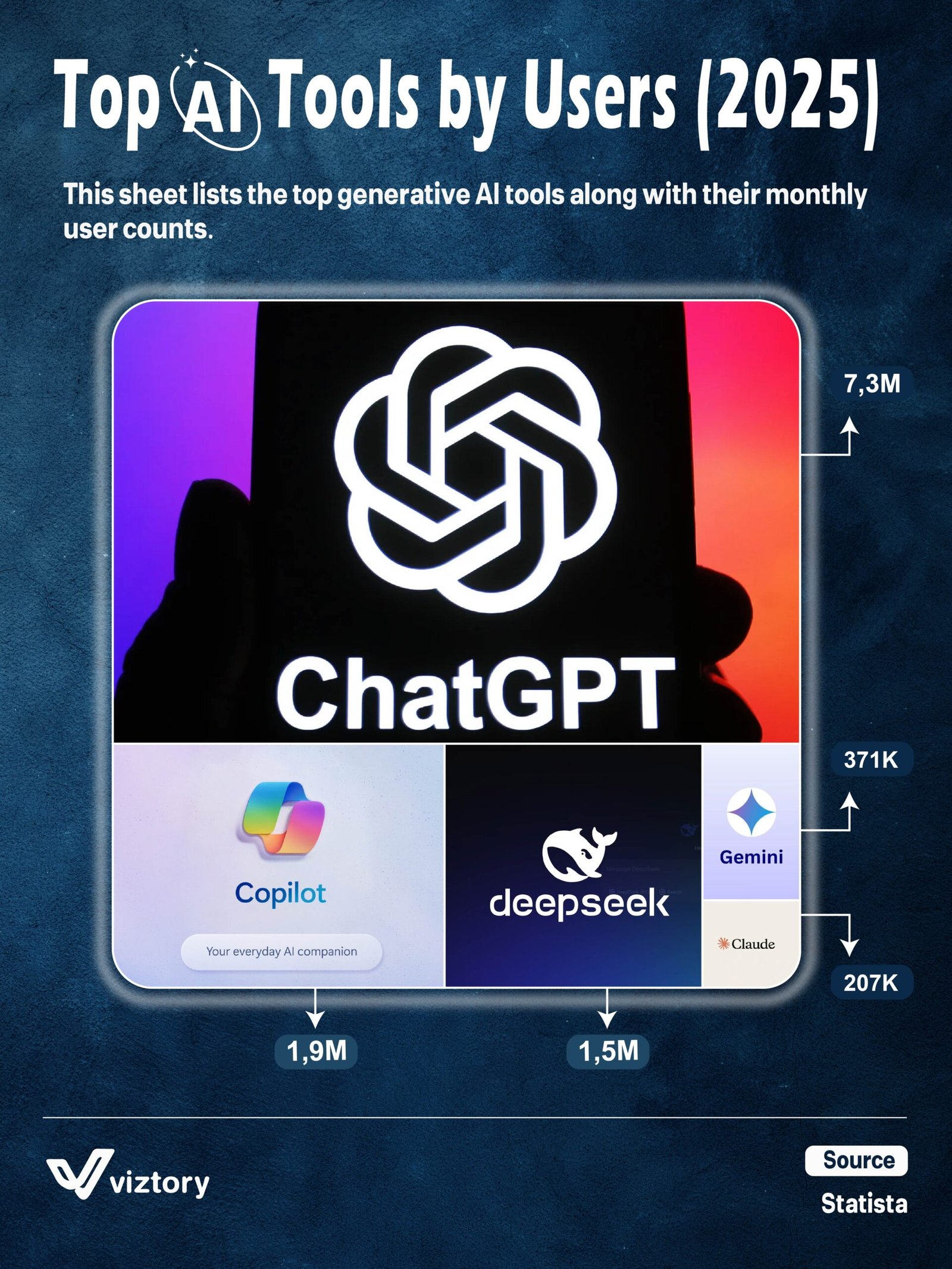

The age of artificial intelligence is not on the horizon—it’s here. As illustrated by the graphic from Viztory, sourced from Statista, the year 2025 sees a competitive landscape for generative AI tools, with platforms vying for attention, data, and dominance. The chart reveals not only usage numbers, but a deeper truth about how money, innovation, and market preference intersect in the evolving AI economy.

User Rankings: Who’s Leading the AI Race?

| Tool | Monthly Users |

|---|---|

| ChatGPT | 7.3M |

| Copilot | 1.9M |

| DeepSeek | 1.5M |

| Gemini | 371K |

| Claude | 207K |

ChatGPT: The Reigning Champion

With 7.3 million active users monthly, OpenAI’s ChatGPT dominates the market. Its blend of accessibility, deep reasoning, multimodal capacity, and widespread integrations makes it the go-to tool for creators, coders, students, and enterprises alike.

From a money perspective, ChatGPT drives revenue across multiple verticals:

-

Subscription models (ChatGPT Plus, Pro)

-

API sales to developers

-

Licensing for enterprise productivity tools

It’s not just a chatbot—it’s an economic engine.

Copilot: Microsoft’s Everyday AI

With 1.9 million users, Copilot—integrated into Microsoft products like Word, Excel, and Outlook—positions itself as a daily assistant, not a standalone chatbot.

It’s a brilliant monetization strategy:

-

Upselling Office 365 subscriptions

-

Boosting productivity for enterprise teams

-

Collecting user insights to refine business intelligence tools

DeepSeek: The Challenger from Asia

At 1.5 million users, DeepSeek is a rising force, particularly in multilingual and region-specific applications. It’s gaining traction in education, translation, and customer service sectors.

Its growth trajectory may be slower, but with targeted regional investments, DeepSeek has serious money-making potential in underrepresented markets.

Smaller Players

-

Gemini (371K users) and Claude (207K users) have promising technology, but limited reach.

-

These tools may excel in specific niches (e.g., scientific AI, legal analysis), but lack the ecosystem or distribution muscle to scale like ChatGPT or Copilot.

-

Their current user base may not generate significant revenue yet, but acquisition or pivoting could shift their financial trajectory.

Money Matters: What These Numbers Really Mean

-

AI as a SaaS business: User volume translates directly into subscription income, training data, and cross-product leverage.

-

Investor confidence: Usage metrics are key indicators for valuation, attracting VC money, or IPO prep.

-

Platform dominance = data dominance: The more users, the more feedback loops, and the better the models. And better models make more money.

Example:

If each ChatGPT user pays $20/month, that’s $146 million in monthly revenue—or nearly $1.75 billion per year, excluding enterprise deals.

Market Analysis: Trends & Takeaways

-

Consolidation is coming: Smaller tools may merge or be acquired by larger tech players.

-

Integration wins: Tools embedded into daily workflows (like Copilot) show better stickiness and higher LTV (lifetime value).

-

AI monetization is maturing: Freemium is giving way to tiered plans, fine-tuned APIs, and enterprise contracts.

Conclusion

The 2025 AI landscape is not just about intelligence—it’s about impact and income. ChatGPT’s supremacy is a testament to early-mover advantage, scale, and continuous product innovation. But the race is far from over.

With generative AI shaping industries from education to finance, tools that maximize user utility and financial scalability will be tomorrow’s unicorns. For developers, investors, and businesses alike, the message is clear:

In AI, user count is currency, and money flows where intelligence works best.