Wealth Growth Across the Globe: Insights from the UBS Global Wealth Report 2024

-

Sep, Sun, 2024

Wealth Growth Across the Globe: Insights from the UBS Global Wealth Report 2024

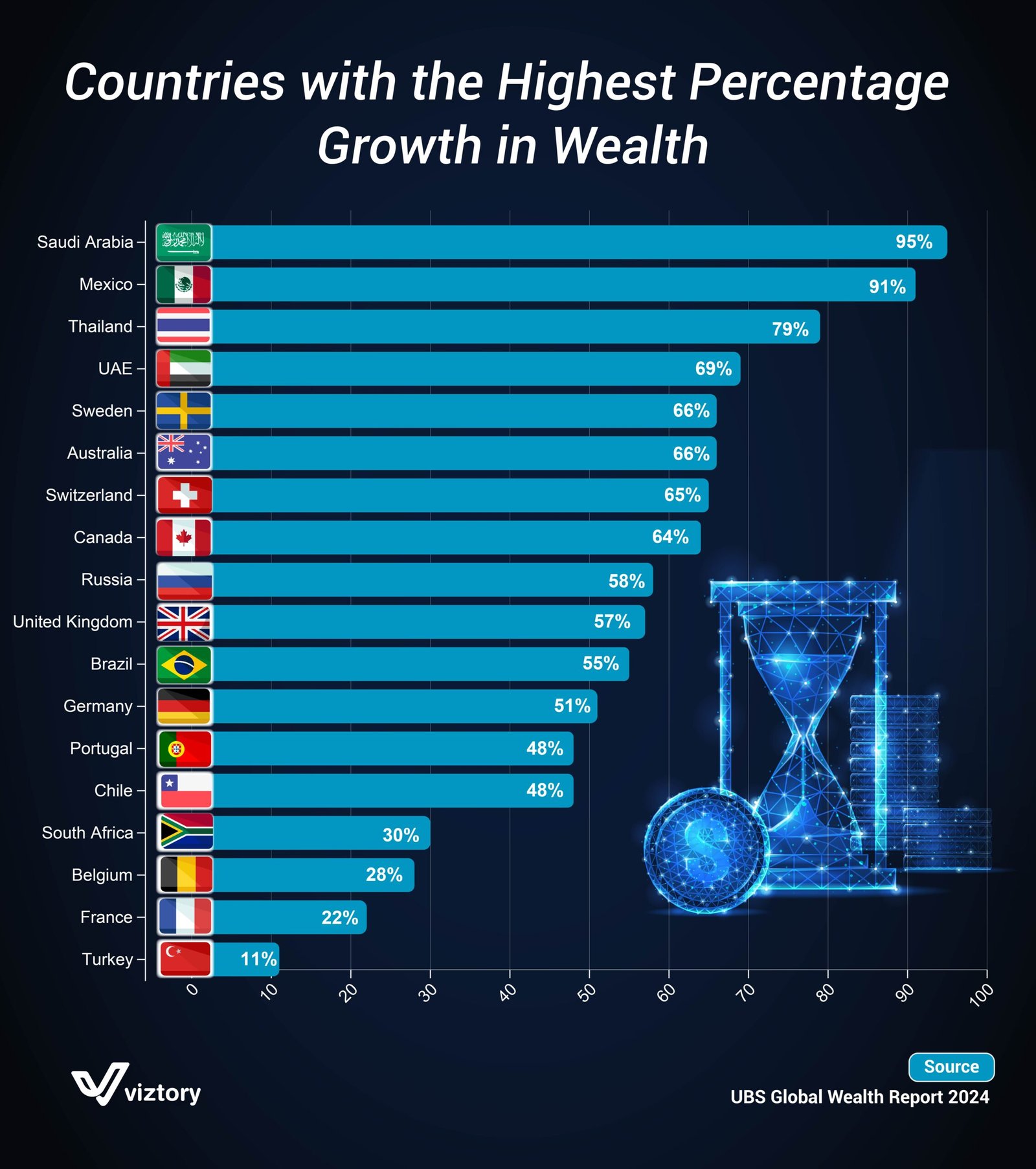

The global landscape of wealth has experienced significant shifts in recent years, with some nations witnessing exponential growth in their wealth percentages. The UBS Global Wealth Report 2024 highlights these changes, showcasing countries that have seen the highest percentage growth in wealth. This article delves into the details behind these numbers, providing context and implications for the future of global wealth distribution.

Leaders in Wealth Growth

At the top of the list is Saudi Arabia, with an astonishing 95% growth in wealth. This surge can largely be attributed to the nation’s strategic investments in diversifying its economy beyond oil, particularly through Vision 2030. This ambitious plan focuses on transforming the kingdom into a global investment powerhouse, fostering economic growth in sectors such as tourism, entertainment, and technology.

Close behind is Mexico, with a 91% increase in wealth. Mexico’s growth is driven by its burgeoning middle class and a strong manufacturing sector, which benefits from trade agreements like the USMCA. Additionally, economic reforms and a focus on digital innovation have played a crucial role in this wealth expansion.

Thailand (79%), UAE (69%), and Sweden (66%) also feature prominently on the list. Thailand’s growth is partly due to its tourism rebound post-pandemic, while the UAE continues to capitalize on its status as a global business hub, attracting significant foreign investments. Sweden’s economic model, with its strong social safety nets and innovative industries, continues to drive consistent wealth growth.

Western Nations: Steady but Slower Growth

Countries like Switzerland (65%), Australia (66%), and Canada (64%) have seen solid growth, albeit at a slightly slower pace. These nations continue to benefit from robust financial systems, stable political environments, and high standards of living, which foster steady economic growth.

Russia (58%) and the United Kingdom (57%) show considerable wealth growth, reflecting their capacity to adapt to global economic changes. Russia’s wealth growth is surprising given the economic sanctions it faces, indicating resilience in certain sectors like energy. The UK’s position is bolstered by its financial services sector, which remains a critical pillar of its economy despite Brexit challenges.

Emerging Markets: The Rising Stars

Emerging markets like Brazil (55%), Portugal (48%), and Chile (48%) are also on the rise. These countries have benefited from a combination of natural resources, growing domestic markets, and increased foreign investments. Brazil, in particular, is leveraging its agricultural strength and mineral resources, while Portugal’s strategic location within the EU and favorable tax regimes have attracted considerable foreign wealth.

Slower Growth in Established Economies

Interestingly, traditional economic powerhouses like Germany (51%), France (22%), and Belgium (28%) are experiencing slower wealth growth. This trend suggests a plateau in wealth expansion, possibly due to mature economies reaching a saturation point. However, these nations continue to enjoy high levels of wealth, albeit with less aggressive growth.

Turkey stands out with the lowest percentage growth in wealth at 11%. This could be due to several factors, including economic instability, inflation, and political challenges that have affected investor confidence and economic growth.

The Implications for the Future

The varied growth rates in wealth across these countries indicate a shifting global economic landscape. Countries like Saudi Arabia, Mexico, and Thailand are emerging as new leaders in wealth growth, driven by economic diversification, favorable investment climates, and strong policy frameworks. Meanwhile, established economies like Germany, France, and Belgium may need to innovate and adapt to maintain their wealth levels in the face of slower growth.

For investors, these trends highlight the importance of looking beyond traditional markets and considering opportunities in emerging economies that are showing rapid wealth accumulation. As the global wealth distribution continues to evolve, understanding these dynamics will be crucial for making informed investment decisions.

The UBS Global Wealth Report 2024 not only provides a snapshot of the current state of wealth distribution but also serves as a guide for future economic trends. With the world economy becoming increasingly interconnected, the shifts in wealth growth across these nations will have far-reaching implications for global markets and financial strategies.